Natural gas Market Conditions

The pace of change in North American natural gas prices over the past few months has been decidedly driven by temperatures, reaching USD 2.50/MMBtu in February 2023 at Henry Hub, one of the lowest levels since the end of Q3 2020. It’s a price trajectory that no one could anticipate, given the nervousness of the North American gas market throughout the second half of 2022.

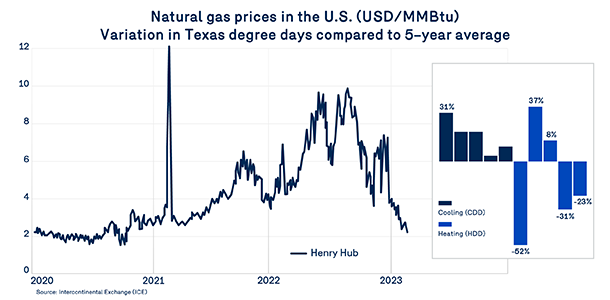

The following graph shows the evolution of the natural gas baseline price in the U.S. (Henry Hub) and the change in heating and cooling degree days in the key state of Texas. The drop in degree days in October 2022 (-52% compared to the 5-year average) contributed significantly to lower prices until cooler temperatures in November caused prices to rise. However, by the end of December, temperatures that were significantly warmer than usual caused heating degree days to fall during the critical months of January and February, with decreases of -31% and -23% respectively compared to their 5-year average.

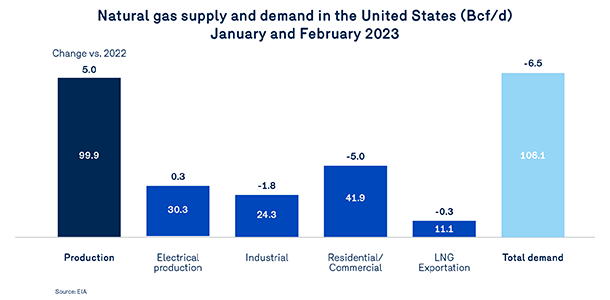

These temperature levels played an important role in reducing demand for natural gas for heating in the U.S. In January and February 2023, demand for the residential and commercial natural gas segments averaged only 41.9 Bcf/d, down -5.0 Bcf/d or -10.7% from the same period in 2022. Combined with other demand factors, total demand was down -5.8 Bcf/d from the first 2 months of 2022. Natural gas prices then naturally plummeted.

Demand for natural gas for liquefaction and LNG exports is on par with last year’s levels. The increase in liquefaction capacity in the first half of 2022 was offset by the shutdown of liquefaction operations at the Freeport, Texas facility since June. Although Freeport liquefaction activities are being resumed, the natural gas demand for these facilities will not return to full liquefaction potential of about 2 Bcf/d until the end of March 2023. In this case, total demand for liquefaction and LNG exports is expected to be near 14 Bcf/d, the maximum level until new facilities are operational in late 2024 or early 2025. However, this return is fully anticipated by futures markets.

In response to this decline in demand, production was up 5.0 Bcf/d from its average level in January and February 2022. Throughout 2022, production grew at a much slower pace than in recent years. While oil and gas producers continue to focus on improving their balance sheets, they are also facing significant increases in production costs and labour shortages. A slowdown in production growth can also be attributed to some transportation gaps from major production basins to consumption sites, particularly in the north between the Appalachian region and New England and in the South-Eastern United States. However, in the face of resilient continental consumption, U.S. natural gas production will remain at 101 Bcf/d, a level the U.S. Energy Information Administration (EIA) expects to reach by the end of 2023.

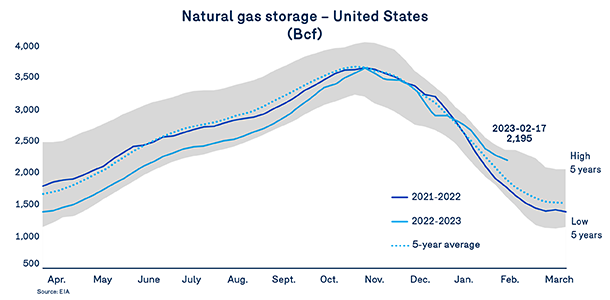

While the overall current environment is driving natural gas prices down in the spot market, it is also driving futures prices down due to improved storage levels, which are now above last year’s level and the historical average, and are nearing the historical maximum recorded over the past 5 years.

Unless temperatures in March 2023 are well below the norm, all indications are that natural gas storage facilities will end the winter of 2022–2023 near historic highs, at levels that will reduce injection requirements in summer2023. At that point, it will still be a matter of temperature. Warmer summer temperatures increase cooling needs and natural gas demand, and reduce the market’s ability to replenish storage facilities for the next winter. But all indications are that the gas market will begin summer 2023 and winter 2023–2024 on a much better footing than in 2022.

It is still a bit too soon to discuss winter of 2023–2024. Without sufficiently reliable temperature forecasts, any attempt to predict the state of the gas market and the gas molecule price in times of strong demand is very difficult.

That said, natural gas markets have stabilized enough that futures prices can move away from 2022’s historic highs. As of February 23, 2023, Dawn’s March to November 2023 natural gas futures prices were trading below $4/GJ. This is an optimistic forecast, but a little more restrained than 2022 as it is based on a normal temperature forecast, fully operational liquefaction activities and growing levels of natural gas production in oil and gas basins in the South-Central U.S.